s corp tax calculator nj

Ad Potential Impacts To Income Tax Accounting Including Interim Estimates And Allowances. Taxes Paid Filed - 100 Guarantee.

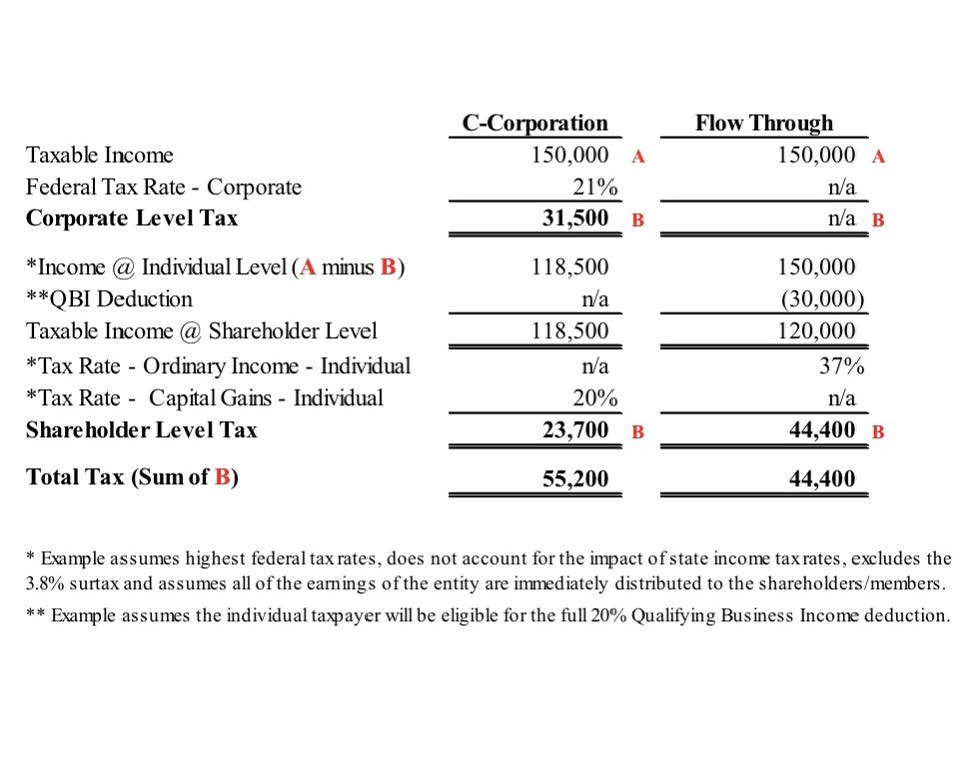

Significant Cuts To The Corporate Tax Rate Is It More Beneficial To Be A C Corporation Now Bernard Robinson Company

Annual state LLC S-Corp.

. Ad Payroll So Easy You Can Set It Up Run It Yourself. Nonprofit and Exempt Organizations. Ad Find Deals on turbo tax online in Software on Amazon.

For more information see the section on Net Gains or Income From Disposition of Property in. This rate 153 is a total of 124 for social security old-age survivors and disability. Taxes Paid Filed - 100 Guarantee.

This page and calculator are not intended to be used and cannot. Discussion And Analysis Of Significant Issues Related To Accounting For Expenses. If you make 70000 a year living in the region of New.

General Instructions for New Jersey S Corporation Business Tax Return and Related Forms - 2 - 187-116a1 through a7 must file the New Jersey Corporation Business Tax Return for Banking and Financial Business Form BFC-1 or the Corporation Business Tax. 63 amended the Corporation Business Tax Act by adding a tax at 1¾ based. IRS CIRCULAR 230 NOTICE.

Find out how much you could save in taxes by trying our free S-Corp Calculator. New jersey state tax quick facts. File a New Jersey S Corporation Election using the online SCORP application.

The 2-month period ends January 7 and 15 days after that is January 22. Our small business tax calculator has a separate line item for meals and entertainment. Ad Count On Our Trusted CPAs For Quality Personal Business Bookkeeping Tax Services More.

Now if 50 of those 75 in expenses was related to meals and. Ad Payroll So Easy You Can Set It Up Run It Yourself. An S corporation S Corp Subchapter S corporation under the IRS code is not.

Licensed Professional Fees. New Jersey Income Tax Calculator 2021. Annual cost of administering a payroll.

New jersey income tax calculator 2021. As noted above a new jersey s corporation pays a reduced tax rate on that portion of entire net income not subject to federal corporate income tax. S corporations are responsible for tax on certain built-in gains and passive income.

Comprehensive CPA Support For Any Tax Income Or Investment Needs.

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

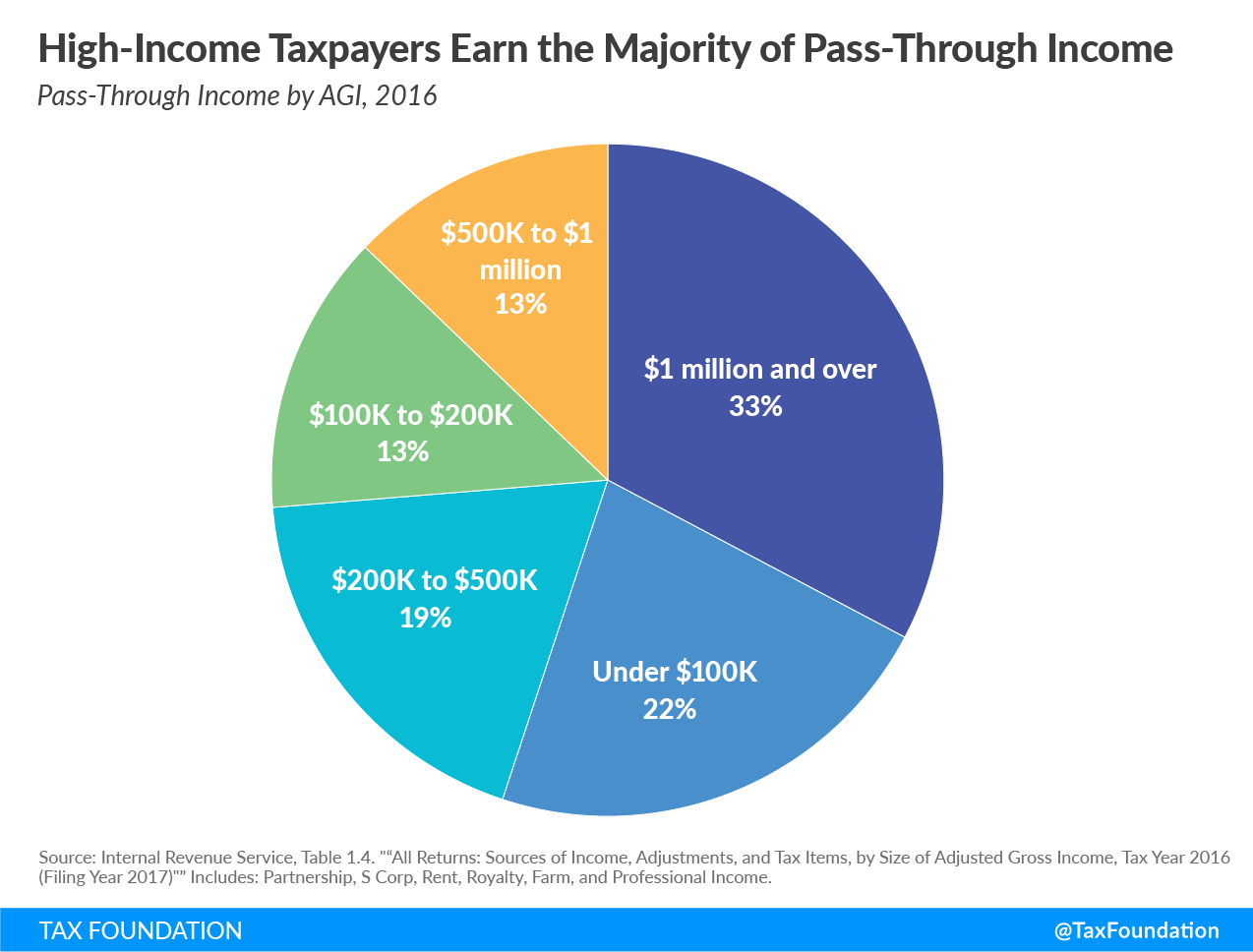

What Is A Pass Through Business How Is It Taxed Tax Foundation

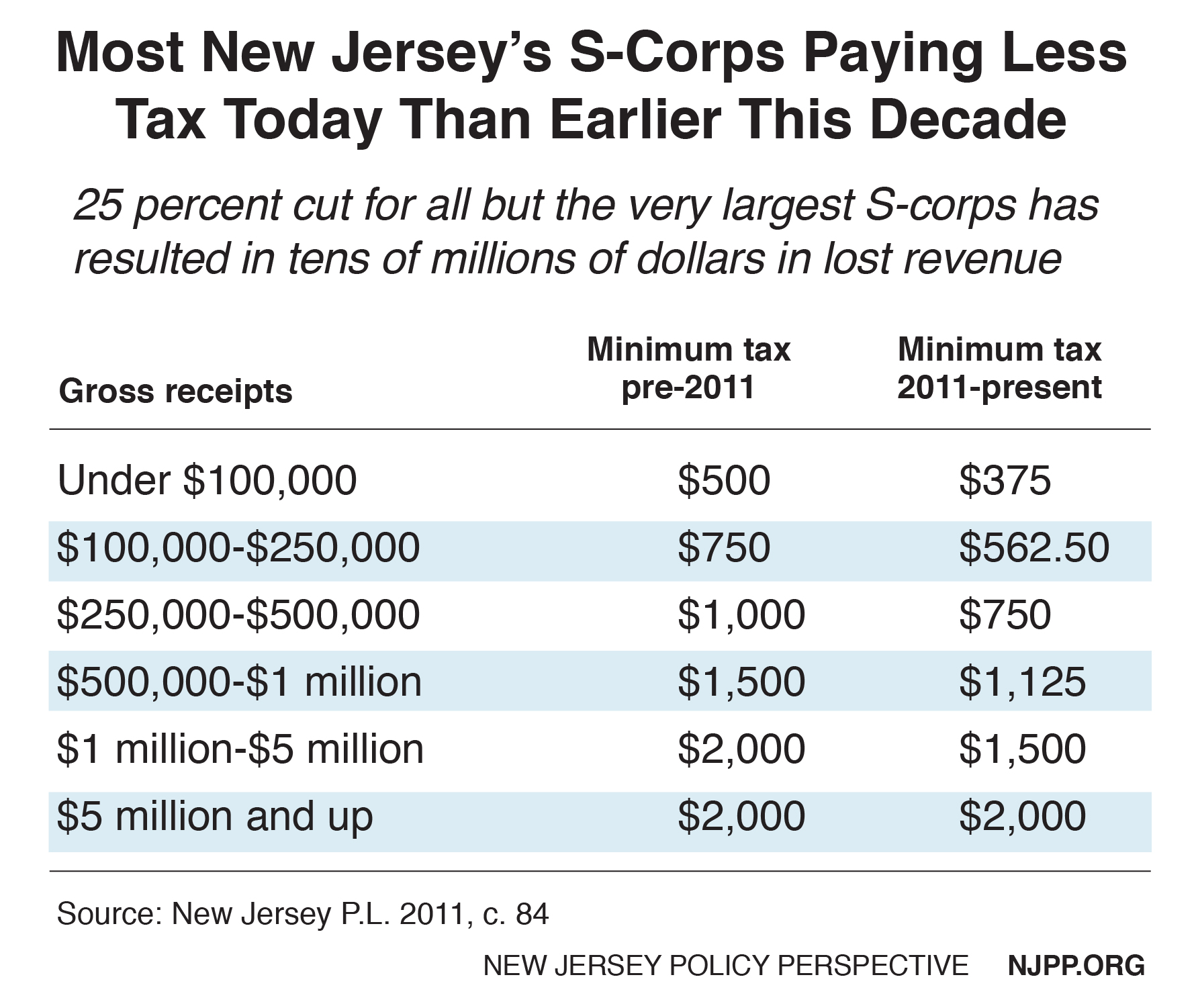

Fixing New Jersey S Broken Corporate Tax Code Will Help Small Businesses Boost The Economy New Jersey Policy Perspective

Quarterly Tax Calculator Calculate Estimated Taxes

Tax Withholding For Pensions And Social Security Sensible Money

New York Hourly Paycheck Calculator Gusto

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

S Corp Vs Llc Difference Between Llc And S Corp Truic

Use This S Corporation Tax Calculator To Estimate Taxes

Llc Tax Calculator Definitive Small Business Tax Estimator

Should You Choose S Corp Tax Status For Your Llc Smartasset

New Jersey Income Tax Calculator Smartasset

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Filing Taxes As An S Corp The Diy Guide

Tax Savings Calculator For Llc Vs S Corp Gusto

Tax Liability What It Is And How To Calculate It Bench Accounting